When you raise $1M on a $5M valuation, that’s selling 20% of the company, right? But what happens when you then raise $7M on a $25M valuation? You’ve sold 28%, you’re already out 48% of your company! Actually no, that’s not the case, and I’ll explain below.

When it comes to modeling dilution and pro rata rights, you can use a simple calculation to build out your current and future financing scenarios and see how it plays out in the long run.

You can access my cap table calculator here to download and use with this article, and use for your own purposes. If you have questions or need help, feel free to comment, or email me or tweet me @chloealpert

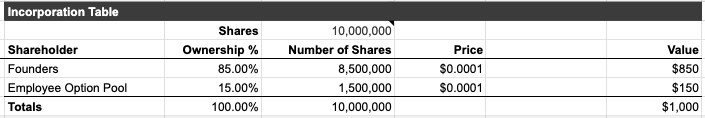

So let’s start by incorporating a company.

What you see is a pretty standard incorporation table. Most companies will generally incorporate a C corporation with 10M shares, but you don’t have to do that. You can incorporate with any number you want, but nice round numbers generally make the math easier. You also will set a par value for your shares, which can be as low as you want, generally $.0001 or some variation is used so you can purchase your stock for next to nothing (because it’s currently worth nothing) and file your 83(b) election.

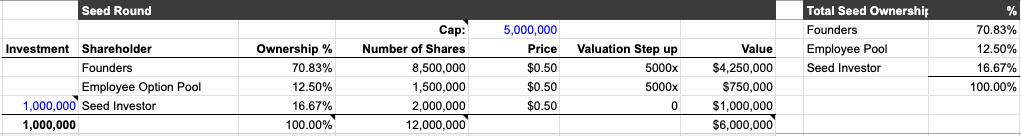

Now let’s assume you go out and raise $1M on a $5M pre-money valuation. This is what the table would look like.

You can see that while the seed investor took 20% of the round, their ownership on a post money basis is actually 16% if you consider the total number of shares between the founders and the employee option pool.

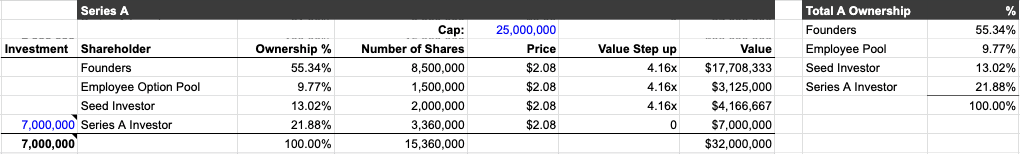

Now similarly, let’s do a series A where the same company raises $7M on a $25M pre-money valuation. The series A investors are taking up 28% of the round, and when modeled out on a post basis, that A investor ends up with 21.8% of the company.

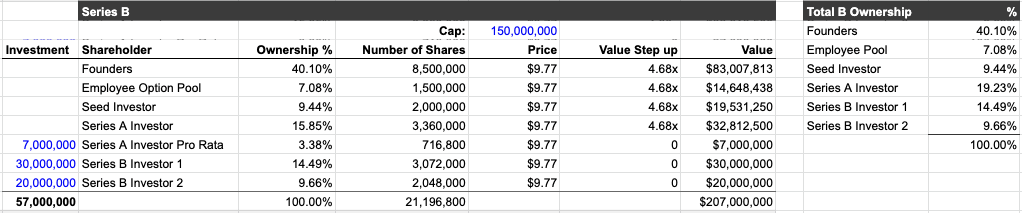

Generally seed and series A investors have ownership targets to maintain, so let’s say we now do a series B, and in order to maintain their ownership percentage, the Series A investor executes their pro rata rights.

Literally translated, pro rata means “according to the rate”, but the way to think about it is basically the right to maintain a proportional ownership percentage of the company.

“You invest $50k in a seed round at a $5mm cap and own 1% of the company. The next round is a $3mm round at $9mm pre, $12mm post. If you don’t participate, you will be diluted 25% and will then own 0.75% of the company. On the other hand, if you buy 1% of the round, a $30k investment, you will continue to own 1% of the company. Your ‘pro-rata right’ in this situation is a $30k allocation in the next round.”

Via Jason Rowley

The math to calculate the pro-rata amounts is simply (target ownership %) x (number of new shares being issued) x (share price at new round). That’s reflected below. What you can see is that the original series A investment is commensurately diluted, but the new money invested as pro rata maintains the ownership target.

In this Series B, there are a few things to pay attention to – the first is that even though the founders have been diluted below 50% ownership, the 4.6x step up in valuation means that founders equity is now worth over $83M with the same number of shares. When you’re raising money you have to understand that there’s a balance between dilution and step ups in share value, and you can’t always be optimizing for dilution. If you truly care about maintaining ownership in your company, you probably shouldn’t take venture capital in the first place. That aside, in this scenario, you can see that the series A investor put additional capital in to execute their pro rata right to maintain close to a 20% ownership target in the company. They most likely won’t participate beyond the B which would be driven by their business model and fund mandate.

Now, not all investors execute their pro rata rights, and sometimes if you allow too many investors to do it, there’s not enough room to complete the round without losing your shirt. Investors understand that if founders are over-diluted at the early stages, they lack incentive to continue operating. So, in as much as you have math driving the valuation, sometimes founders will have no choice other than to block or limit pro rata amounts of existing investors. This can often result in hurt feelings and some angry words and it’s unfortunately one of the crappy sides of raising money, particularly as you get bigger and start making money.

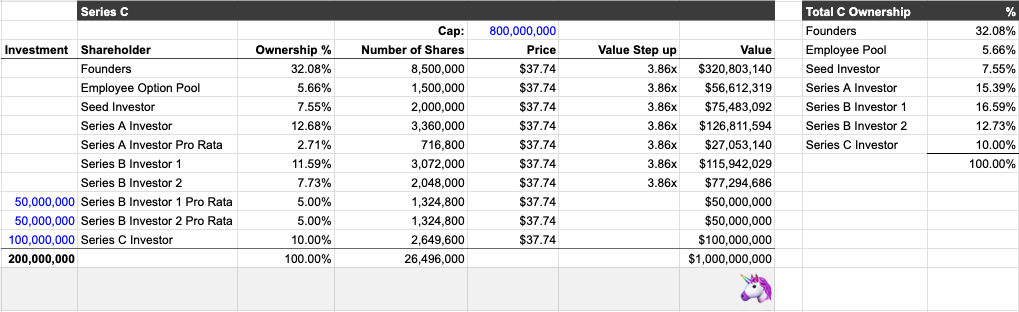

To close it out, I figured we’d make our company close a series C and hit unicorn status on a post-money basis. As you can see, the founders still own quite a large amount, and generally what founders would do at this round (and usually the B) is something called a secondary sale.

The reason investors would push for founders in particular to do a secondary sale of their private company stock is to give the founders some initial liquidity for their time. The idea is that this will make them less risk-adverse when it comes to pushing for the company to go big, as well as make some of their shares available to existing investors who might want to expand their ownership prior to going public.

All in all, this is a quick oversimplification of a very complex topic, but hopefully this will give first time founders a sense of how to model ownership and investment into their companies and plan for the future.

One response

[…] If you want to learn more about pro rata rights, you can read my post on how to model ownership & dilution and how pro rata works. […]